Written by Jeremy Fletcher | January, 22 2023

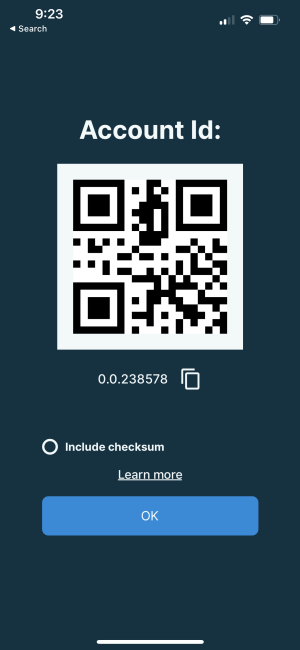

Account QR Code

The account QR code generated currently by Wallawallet is a QR code that simply encodes only the account id as free text, with or without the checksum depending on the option you choose.

The account id that is encoded in the QR code is displayed below the QR code in text form.

The “Include checksum” checkbox is checked by default if you have “Require Checksum in Account Id” enabled under Settings => ADVANCED.

You can still enable or disable the checksum in the generated QR code by clicking on or off the “Include checksum” checkbox.

Please be aware that memos are not included in the QR code.

If one person generates the account id using the Receive button for their account, another person can use Wallawallet to scan that QR code to fill in the same account id in their “Send” dialog.

Account id Checksum

The checksum is comprised of 5 lowercase letters appended to the Hedera account id and separated by a dash. An example is 0.0.12345-lwnwn, where lwnwn is the checksum. The checksum is mathematically calculated based on the account id and the network being used (mainnet, testnet or previewnet).

The purpose of the checksum is to make it much more difficult to lose funds by sending them to an unintended recipient.

For example, if I don’t use a checksum and accidentally type 0.0.112345 into Wallawallet when I intended to type 0.0.12345, I now have lost my funds and should immediately send a very small followup payment to that account with a memo field asking the account owner for 0.0.112345 if they would be so kind as to send my funds back to my account id.

If checksums are required however, and the owner of account 0.0.12345 gives me the full account id with the checksum needed for payment, they will send me 0.0.12345-lwnwn and it’s much harder to make a typo or lose funds, because the checksum for account 0.0.112345 is qudnu, so 0.0.12345-lwnwn and 0.0.112345-qudnu are radically different, and if the checksums are not entered correctly for a given recipient account id, no funds will be lost.